(DTCK) This insight was shared by Mr. Nguyen Thanh Binh, General Director of Gemadept Corporation (GMD – HOSE), at the online conference titled “Connecting with Gemadept (GMD) Leadership: In-depth perspectives from businesses and HSC experts.” The event was organized by Ho Chi Minh City Securities Company (HSC) in collaboration with Gemadept.

When the information regarding retaliatory tariffs from the US was announced, although subsequently postponed for 90 days for negotiations, some investors remained concerned about a potential impact on the seaport industry.

However, in the first half of April 2025 (the period after the retaliatory tariffs were announced), data from the General Department of Vietnam Customs showed that while Vietnam’s import-export turnover decreased compared to the latter half of March, it still achieved strong growth year-on-year. Specifically, export turnover reached $16.7 billion, an increase of 10.5%, while import turnover hit $18.7 billion, up 16.7% over the same period.

Regarding the immediate outlook for the seaport industry’s output in Q2 2025, Ms. Che Thi Mai Trang, Head of Industrial Sector Analysis at HSC, stated: “We believe that export turnover to the US in Q2 2025 will continue to grow strongly due to ongoing ‘frontloading,’ as businesses accelerate shipments to the US to avoid the retaliatory tariff deadline, and Vietnamese goods remain competitive in the US market.”

“Frontloading” is a strategy in the shipping and logistics sector where import activities are accelerated ahead of undesirable changes, such as increased tariffs or labor strikes. This ensures goods arrive on time without disruption, allowing businesses to avoid risks and additional costs while optimizing transportation expenses.

Mirroring the positive trend in the industry, Gemadept Corporation (GMD – HOSE), a leading enterprise in port operation, also reported strong business results in the first quarter of 2025. Specifically, Gemadept recorded a 22% increase in revenue, reaching VND 1,277 billion, and a 57% surge in profit-before-tax to VND 583 billion.

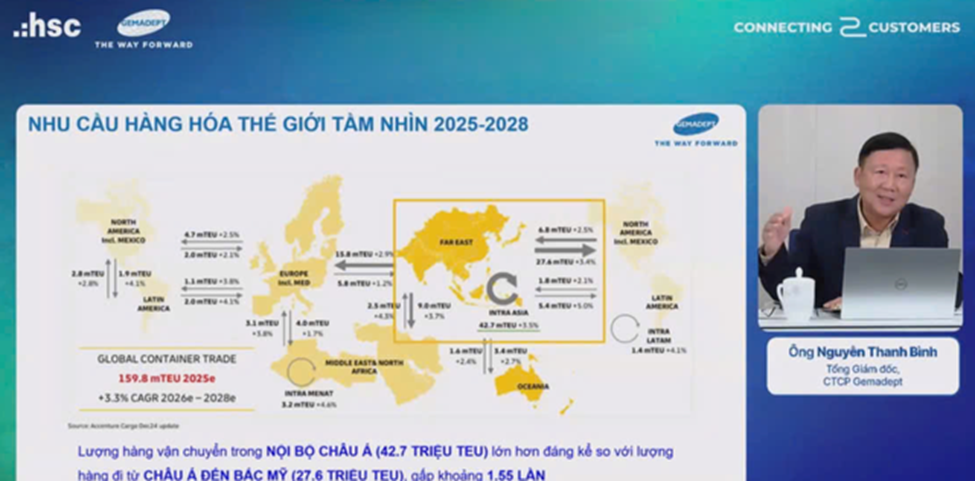

Mr. Nguyen Thanh Binh, CEO of Gemadept, commented that while negotiations are still ongoing, the impact of retaliatory tariffs on the supply chain, logistics industry, and seaports is inevitable. In particular, shipping lines, airlines, and logistics companies are having to re-establish supply chains and shipping routes. Meanwhile, manufacturers are diversifying supply chains and services and seeking alternative markets.

However, Gemadept’s CEO also noted that Vietnam still possesses unique advantages, coupled with its Free Trade Agreements (FTAs) with various countries. Therefore, businesses have ample opportunities to focus on expansion and discover new alternative markets, such as those in the EU or within Asia. Businesses are seeing this as a chance to restructure operations, seek new markets, and diversify their reach. Furthermore, with warehousing costs only 40-50% of those in other regional ports, Vietnam could become a destination for empty containers after negotiations, awaiting signs of market recovery.

Despite some market concerns, Gemadept remains committed to its 2025 business plan targets, with no downward revision of projected output. Accordingly, in 2025, Nam Dinh Vu Port is still expected to handle 1.35 million TEU (the port’s capacity will increase by 50% from its current level to 2 million TEU by the end of 2025 when Phase 3 is completed and put into operation). At Gemalink Port, the projected output is 1.7 to 1.8 million TEU. Of this, cargo bound for the US accounts for only 10% at Nam Dinh Vu Port and 20-25% at Gemalink Port.

To support its growth and expansion, Gemadept is proactively adapting its operations and implementing flexible strategies. This involves building business scenarios, diversifying into other markets to reduce US dependence, and working with shipping lines to adjust and develop new routes to areas like Africa, Europe, and Canada.

Mr. Binh said, “The Company expects good business results in the first 6 months of 2025, driven by anticipated increased output before the tariff deadline.”

Gemadept currently holds around VND 5,000 billion in cash and expects to add another VND 1,000 billion by the end of June 2025.

Gemadept’s leadership also shared plans to seek out core investment opportunities in the near future to enrich the company’s port and logistics ecosystem. Concurrently, with the expectation of a 10-15% adjustment in deep-sea port handling fees soon, Gemadept and other port enterprises could gain additional capital to reinvest in developing green – smart ports. This would better meet the requirements of partner shipping lines and contribute to boosting national economic growth.

“As a leading enterprise in the industry, Gemadept continues to proactively develop business scenarios to respond to tariff and market developments. In the coming period, the Company still has significant potential for capacity expansion, ecosystem optimization, and enhanced synergy and cooperation with global partners to participate in more potential projects. Gemadept, a leading port and logistics enterprise with 35 years of development, always maintains a steady stance, sustains growth, and creates a strong foundation for its 2030 vision,” Mr. Binh emphasized.

Source: Tin Nhanh Chứng Khoán